State of Startup Seed Funding in Australia and USA 2024

Diving into the latest early stage funding data and my startup funding cheatsheet for 2024

Its a tough environment to raise capital for founders right now. VCs are deploying slower and investors are generally in risk off mode, preferring to invest into less risky companies and assets.

In this post I wanted to share some of the latest funding data with a focus on pre-seed to seed stage startup funding in the USA and Australia from a VC perspective and share some practical tips from our founders that are raising capital.

But first: The 2024 Startup Funding Cheatsheet

Presenting my first attempt at a startup funding cheatsheet for 2024 based on data compiled below and from Galileo Ventures.

Read on for full details and feedback welcome!

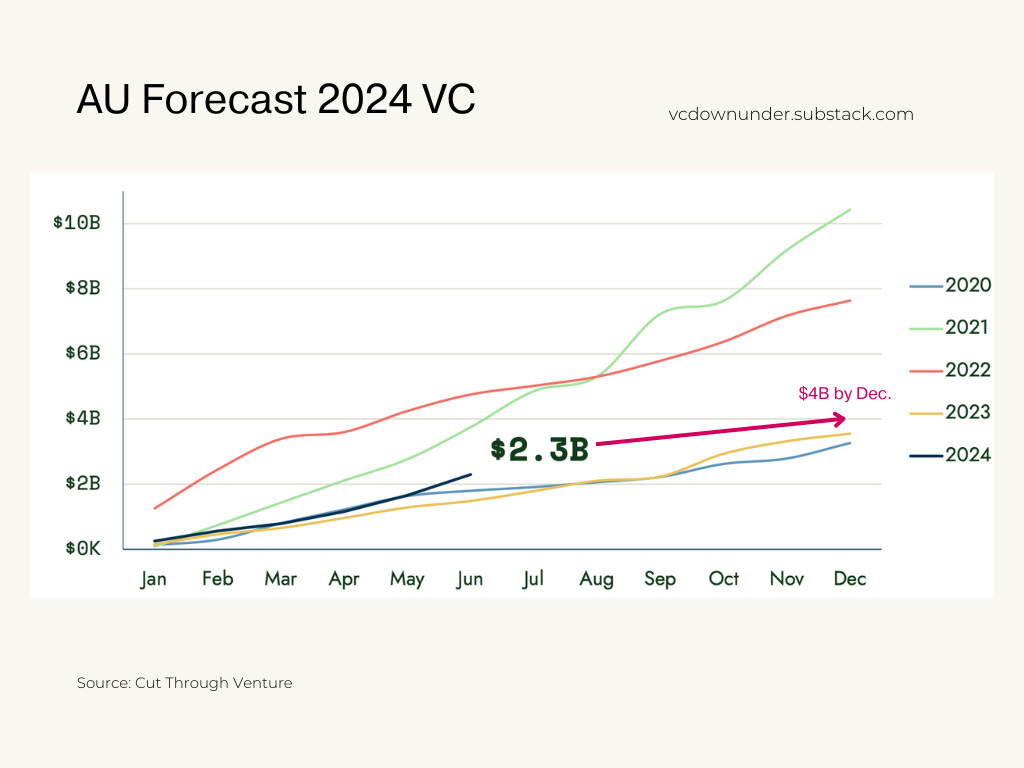

We’re back to 2020 funding rates in AU and USA 📉

I like to think that we’re now back on track to growing year on year with similar growth rates from 2020. In the USA and AU 2024 year end out look are similar, perhaps AU will end up higher as % YoY growth than US but time will tell.

In Australia 2024 has seen $2.3B raised across ~150 deals. While Q1 was down , Q2 was up for AU YoY and we’ll probably end up higher than 2023.

The data from PitchBook is similar, if not slightly less (I find they typically undercount AU) but as we can clearly see we’re back to 2020 funding rates per quarter growing YoY.

USA deal activity down

In the USA its similar story with $93B deployed but with significantly less volume of deals as larger funding rounds dominate (AI funding). USA funding in Q2 had a slight uptick but its unclear if it will beat 2023 in total deal value and may end up less than 2020.

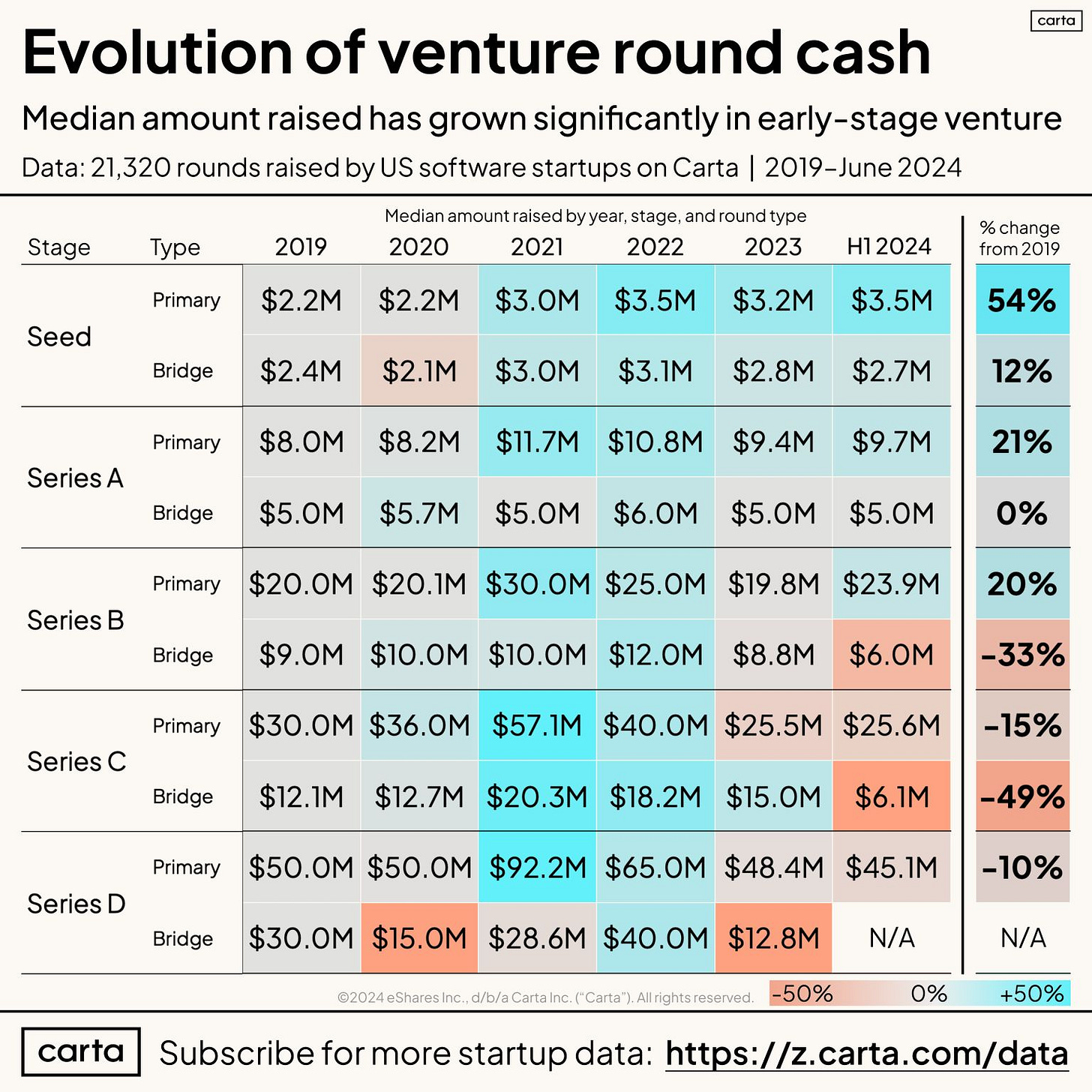

Seed rounds pop but late stage deflates

US Seed Rounds are +54% larger but Series C Bridge rounds -49% ☠️

Data from US software startups from 2019 show how much larger seed rounds have become which is similar in AU.

The canary in the coal mine is:

Number of early stage bridge rounds, and size of round, has increased significantly, to the point its the ‘new normal’ as startups struggle to raise subsequent rounds

Later stage rounds are decreasing in size which means much worse funding availability, higher revenue targets but less cash to grow.

Theres also significantly less Series A-C rounds happening

To summarise this implies much higher failure rates from Seed → A/B/C in coming 1-3 years.

The question I ponder is will US pre-A rounds revert back to 2020 rates or keep growing in coming 3 years? It seems likely they’ll keep growing due to the huge number of seed funds in the US that still have a lot of dry powder.

AU Seed +100% Larger but Pre-Seed Stable

In Australia pre-seed rounds median remain flat around A$500k-$800k but there is a growth in Seed rounds to median of A$2m. Larger VC funds are pouring cash into earlier stage deals due to the drying up of growth capital and reduction in overseas investors in later stage deals.

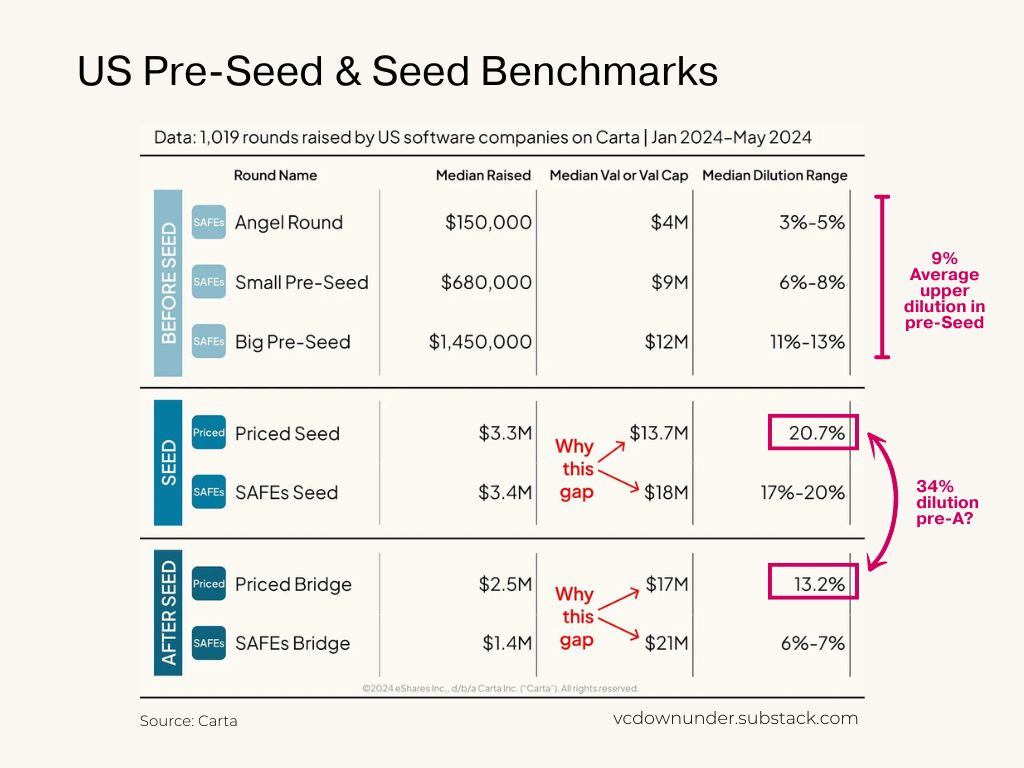

Valuations and dilution in pre-seed to seed rounds

For pre-A rounds size and dilution can vary. In fact the median seed-stage dilution to jumps up to 20% in priced rounds versus 10% on average for pre-seed.

Importantly while SAFEs have shot up in popularity founders need to beware of dilution – there is a significant gap between priced rounds and valuation caps of SAFEs (see below) which implies that at the next round founders run the risk of get way more dilution than they hoped for at conversion.

Keep in mind that traction thresholds for getting a good Series A are all up significantly – so while the SAFE sounds great, to shoot past your valuation cap is much harder than last few years ago.

Seed bridge rounds becoming new normal (but valuations remain flat)

The volume of Series A rounds are down while benchmarks to trigger an A-round are up for every sector (even in AI). This means founders are raising more ‘Pre-A’ bridge rounds with flat valuation – this may cause more dilution for a lot less money.

See the gap below between priced vs SAFE post-money valuation caps. If you take the price round medians (which is a much better signal) founders are potentially diluting the company by 34% before they even raise a series A.

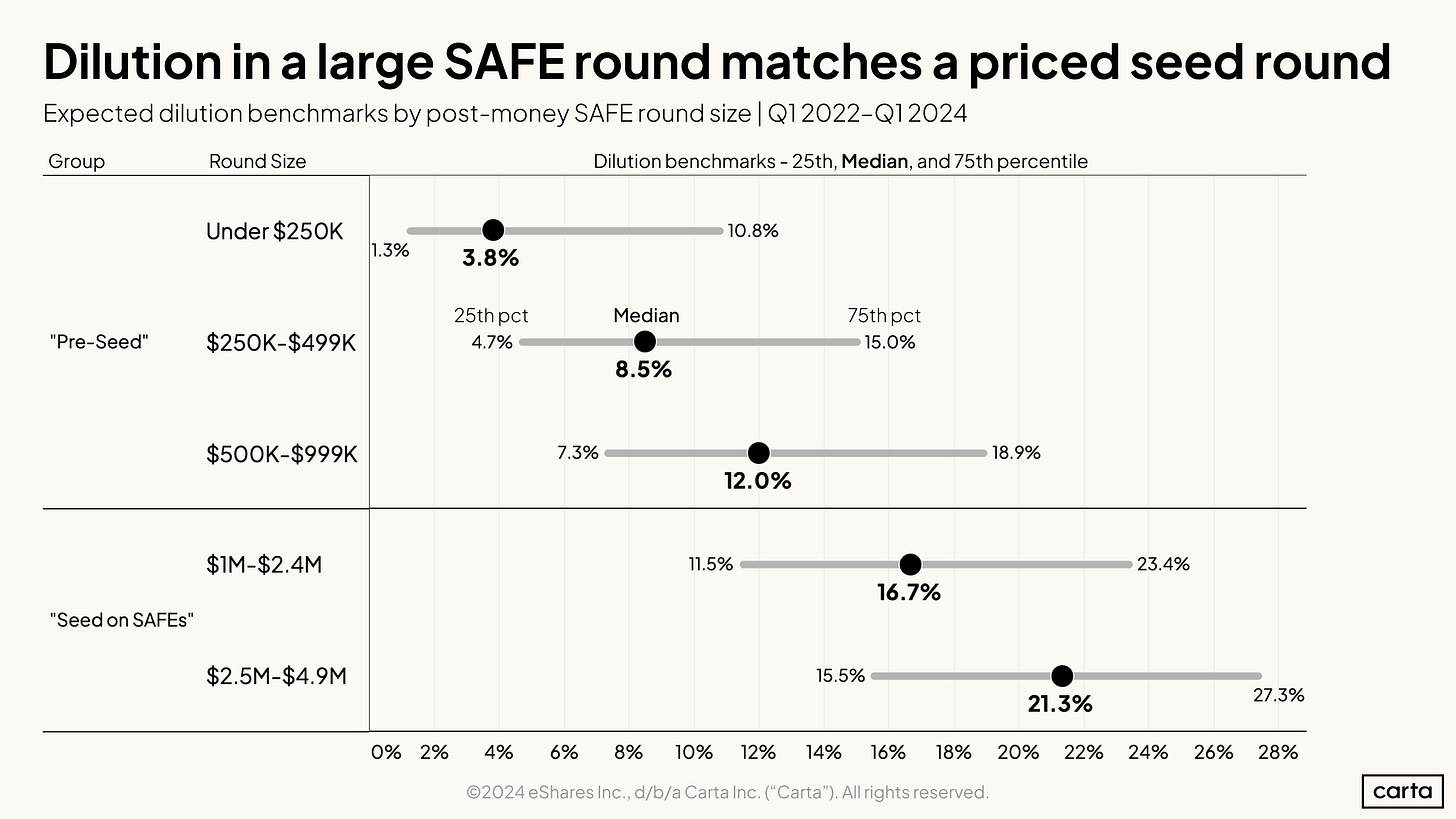

Round labels are fluid but dilution increases with round size regardless

While what is labeled ‘pre-seed’ versus ‘seed’ might be fluid as you raise more than $3m the dilution goes up considerably with an upper bound of 27% dilution in the data below.

AU VCs estimate 30% average fall in pre-seed & seed valuations

AU VCs sentiment suggests a fall in early stage valuations but on the on ground we’re seeing that most pre-seed rounds are flat or similar to previous years with pre-seed founders seemingly still thinking its 2021 and that starting high is a good thing.

We know seed stage round sizes are increasing as less Series A rounds are being done – most founders are opting for Seed+ rounds vs down-round in their Series A. Does that mean valuations are increasing? Not necessarily.

We don’t have a Carta-scale equivalent in AU so below is sentiment but nonetheless instructive as to what to expect when negotiating.

Bigger is not always better (in this market)

My advice to pre-seed founders is to be capital efficient, raise a smaller round and get the proof points you need and then go out.

In the US Q12024 there was 2x more <$1m pre-seed rounds done vs Seed.

Similarly, in AU spending 12 months raising a large seed or 3-6 months raising a smaller round to move faster and get key proof points to enable more investment could be the right strategy in this market.

Keep in mind with SAFEs you can close each investor individually and keep investment coming in the door (just be careful of stacked SAFEs with different terms). But of course, the ‘right strategy’ depends on a lot of factors.

My fundraising tips for pre-seed to seed stage founders

I wanted to share my tips and lessons from looking at over 600 pre-seed and seed stage companies over the past 12 months:

Don’t make your valuation your goal: I’m seeing founders forgo cash today for higher valuation aspirations in the future – faster speed of execution is your moat in the early days.

Don’t blow your valuation out of the water in your first round: Be mindful that having a lead give you a high valuation may restrict future investors too in the down and middle-case scenarios.

Capital efficiency is king (again): Reduce your burn, aim to be capital efficient until you have real business traction and growth.

Growth rates > total revenue/customers: Higher growth will command much better round valuations and VC interest.

High customer retention > fast growth: Equally, growing slower to achieve stronger early results with your first customers is much better than higher growth rates but low retention (hello AI startups).

Small pre-seed rounds are Good: Consider reducing your pre-seed raise target. There are more smaller pre-seed deals (<$1m) happening then larger pre-seed rounds.

Disclaimer: As with all early stage startup data and advice, it is hard to generalise over every sector and situation. Theses are general comments only.