Australia to hit A$4.8 billion (US$3) in VC funding in 2025?

A few predictions and thoughts on VC funding growth in Australia and current investment trends in AU and USA.

Hello from San Francisco!

I’m in the US because Galileo is expanding our presence and the first Aussie early stage VC to setup an office to help our founders expand and back other exceptional Aussies in the Bay Area. If you’re one of them, please reach out.

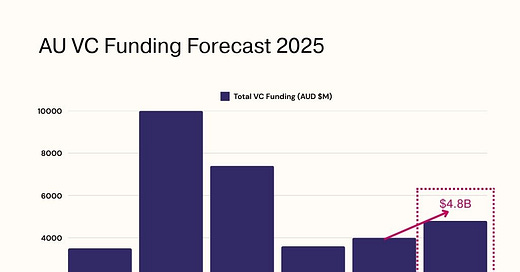

Back in middle of last year I predicted that Australia would hit $4B in total VC funding for 2024 and well, that turned out to be true. The latest data from Cut Through Venture (see below) shows AU hitting $4B in 2024 VC startup funding, approximately 10% YoY growth from 2023.

My prediction for 2025 is that AU VC funding levels are ‘back on track’ which has been approximately 20% YoY over the last 5 years (based on my research) which means AU will hit approximately $4.8 billion ($US3B) in 2025.

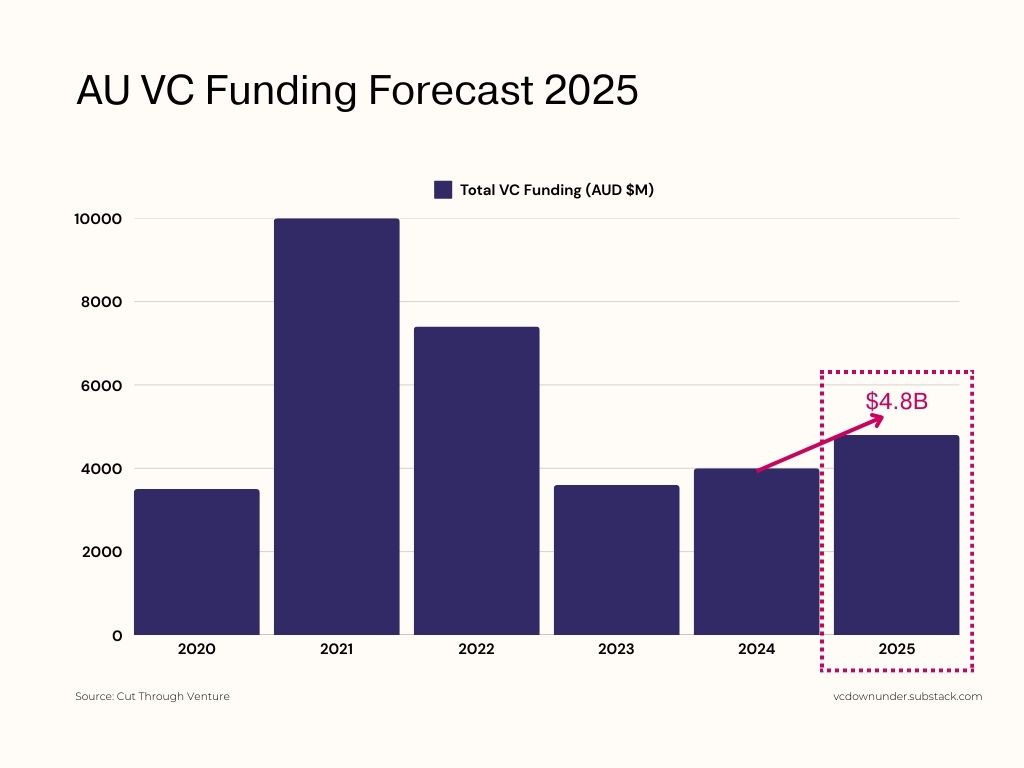

Over 5 year period until 2023 AU ranks 2nd globally for VC investment growth, behind South Korea and ahead of Singapore. If this continues I predict Australian based funds (investing globally) may over take Singapore within the next 10 years, depending on how much regional tech funding ends up flowing into Singapore vs Australia.

Breaking down per capita VC funding and growth

While total dollars will always be more in larger markets, a better dimension I think is to look at per capita funding as a signal for tech innovation health.

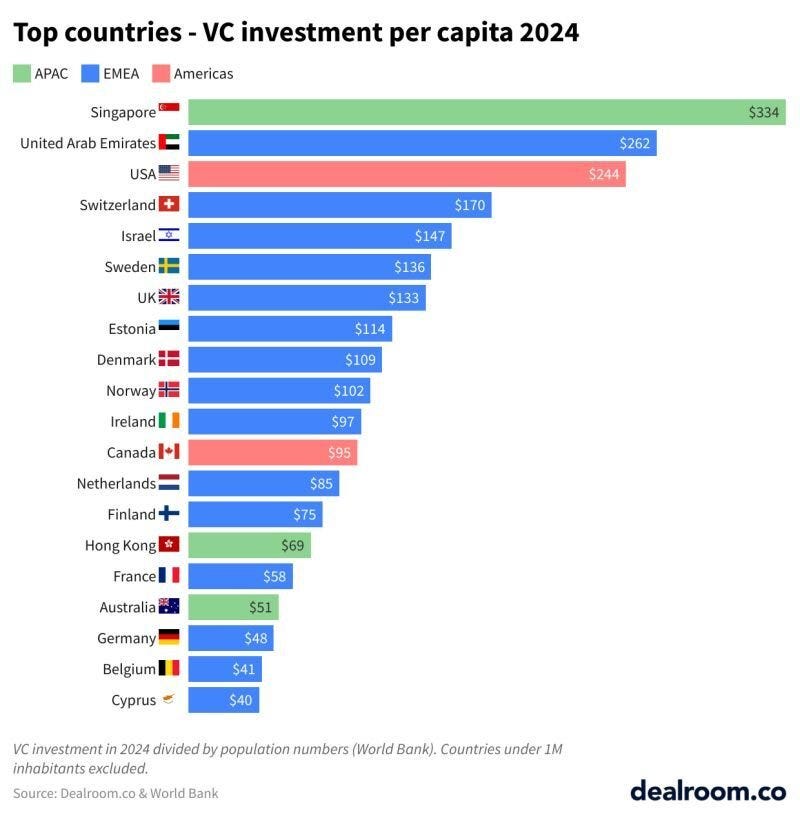

In 2024 in Australia A$150 (USD$67) was invested per person into startups, well below US with approximately $600 per capita and total of ~$200b invested, and UK with $235 per capita with ~$16b invested (compiled with support of DeepResearch, numbers vary slightly depending on which sources you use for yearly funding amounts ).

Top 20 Countries by VC investment per capita (Deep research)

I then asked Deep research to compile a list with updated funding amounts. This is mostly correct, again it depends one which sources you use to count yearly funding per country.

According to this list Australia now ranks 15th globally for VC per capita funding which is higher than previous years when Australia was not even in top 20.

GPT: Below is an updated ranking of the top 20 countries by venture capital (VC) investment per capita for full-year 2024, along with their total VC funding in 2024 (in USD). All figures are the latest full-year 2024 estimates or reports (beyond Dealroom’s mid-2024 data) and converted to USD for consistency. Countries are ranked by VC investment per capita, and total funding levels are provided for context:

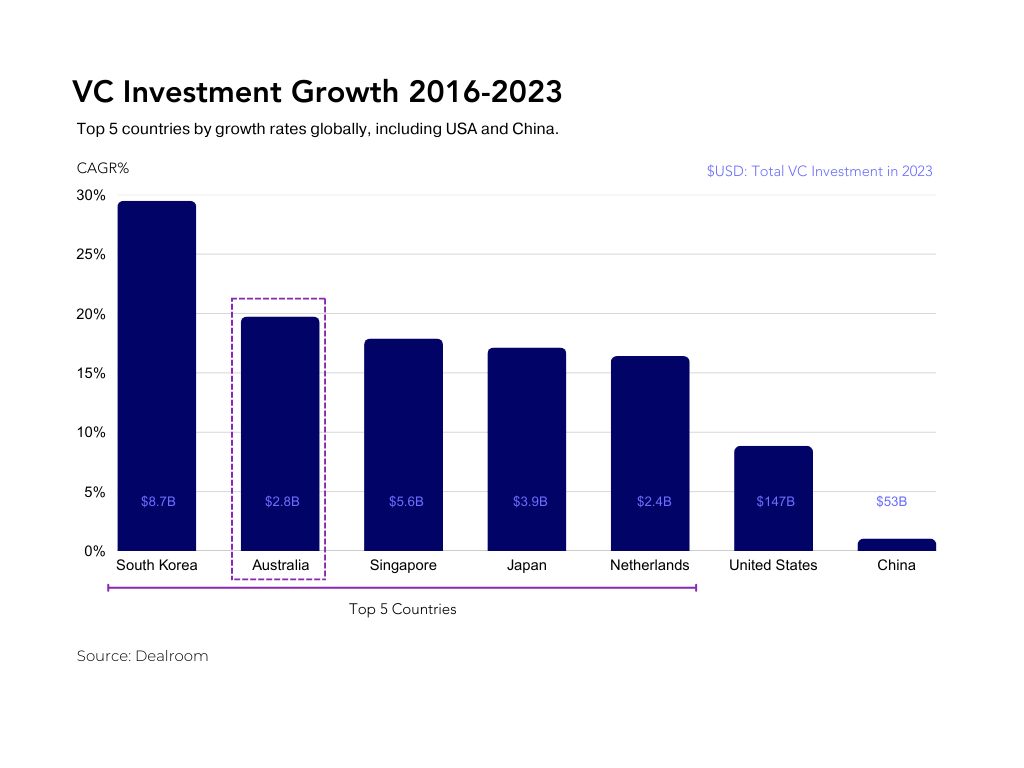

Now compare this to Dealroom mid-year 2024 data per capita rankings looked like this with Australia at 17 globally:

Looking at country level data Pitchbook has a Development Score which ranks Australia 13th globally based on deal value, counts, funds and exits.

I think this is more interesting score when looking at multiple dimensions and shows Australia’s raising tech sector significance on the global stage.

Overall Trends I’m Seeing

A few thoughts based on what I’m hearing from other VCs and the deals I’m seeing on the ground in AU and SF:

Overall fewer deals, more mega rounds i.e. more money going to a fewer companies seems to be happening in both ecosystems e.g. deals like OpenAI and Databricks are accounting for vast majority of growth in VC funding

In Australia 20 largest deals accounted for 50% of total funding (vs 45% in 2023)

Strong seed-stage interest is pushing up valuations higher earlier (take in more funding)

Companies are struggling to raise big Series A and B rounds unless they’re AI companies

In SF, AI seems to be 90% of deals whereas in Australia its clear that AI is still only a growing proportion with fintech and enterprise SaaS generally still dominant

Australia’s Unicorns have not be ‘dethroned’ i.e not public revaluations but we only have 16 right now vs over 700 in the USA - is there a coming unicorn apocalypse?

Overall, capital efficency is the name of the game - keep burn as low as possible, grow efficiently, prove value (and margins)

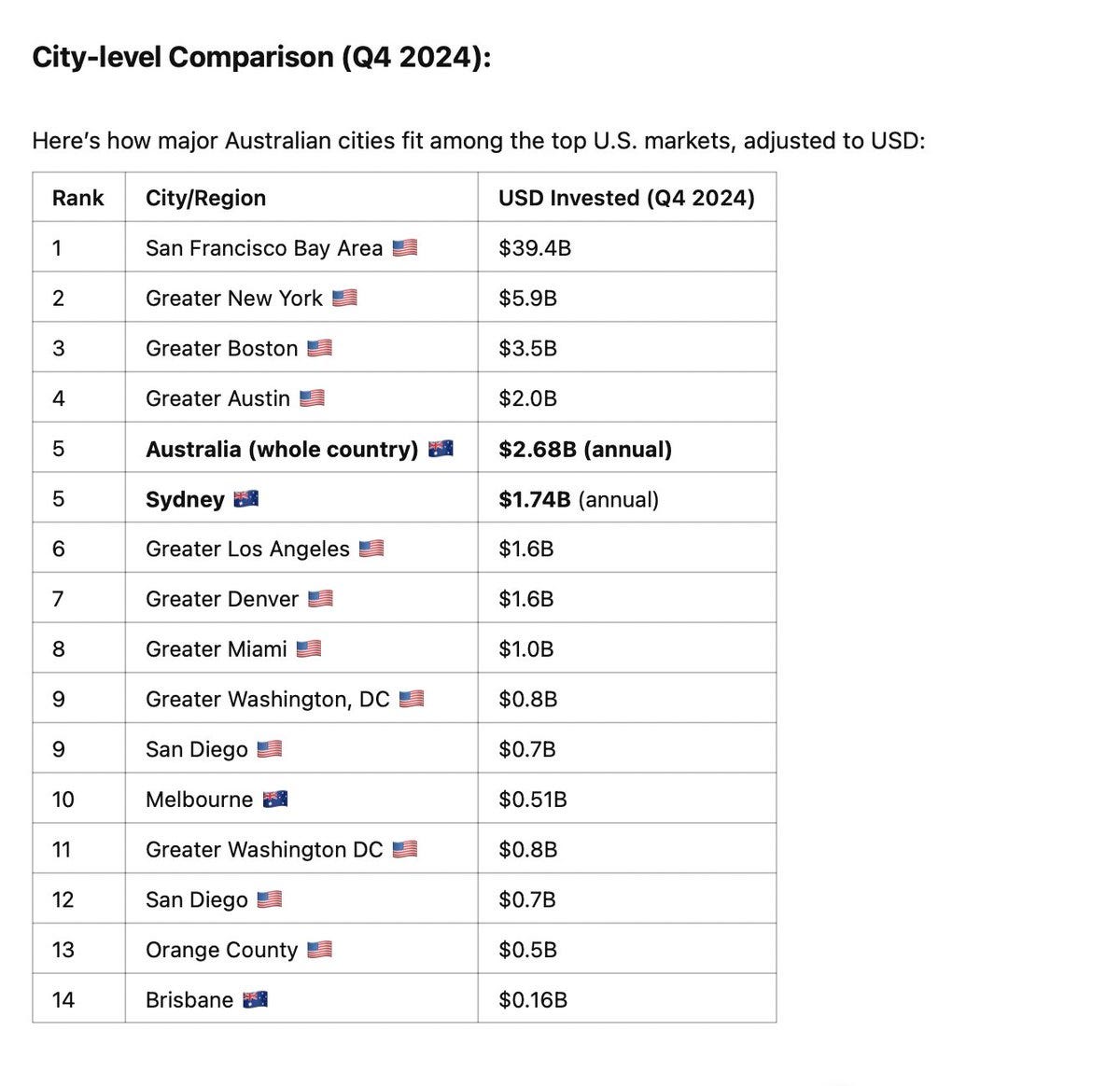

If we were a US city, we would rank ~5th for just last quarter. (imperfect but fun comparison)